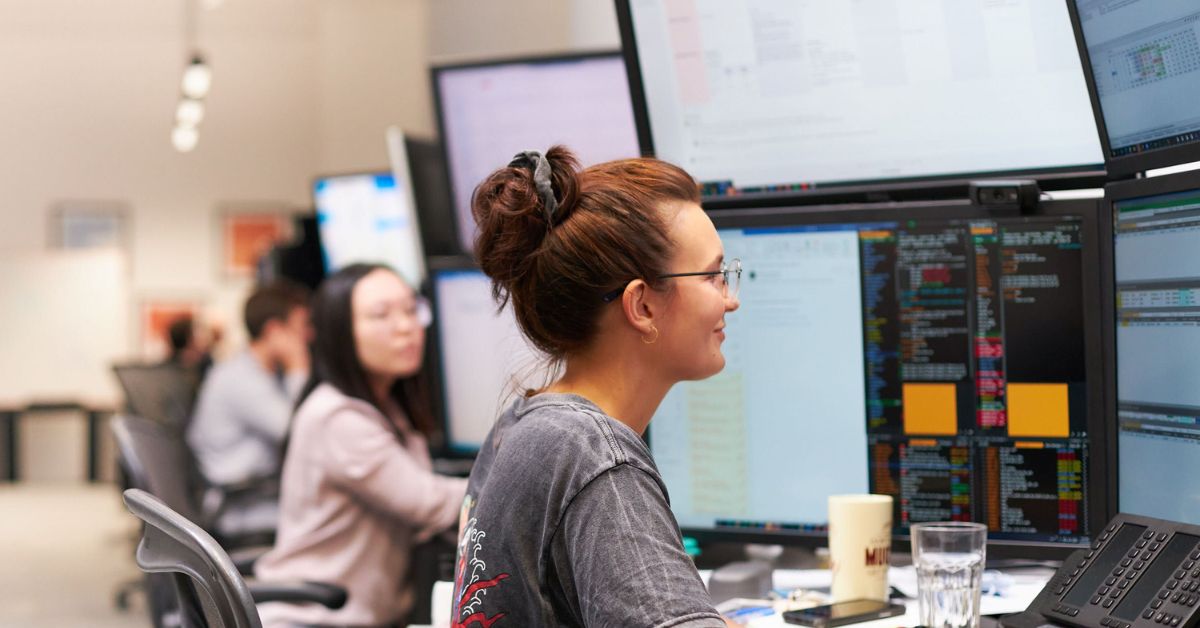

Google stock is a popular choice for many investors. On FintechZoom, you can find news and updates about Google’s stock and how it’s doing in the market. Whether you’re just starting to invest or have experience, FintechZoom makes it easy to stay informed and make smart choices about Google stock.

Google stock is a popular choice for many people who invest. On FintechZoom, you can find the latest news and updates about how Google’s stock is performing. This helps you make smart choices about your investments, whether you’re new to it or already have some experience.

In this article, we’ll discuss “FintechZoom Google Stock“ and share important updates to help you understand its market performance.

Overview of Google Stock:

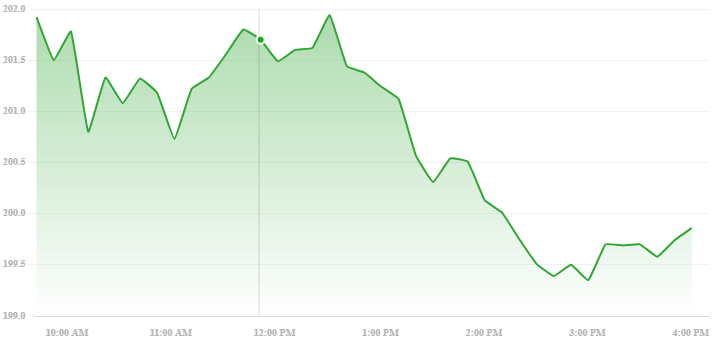

Alphabet Inc (GOOG)

$200.16

+$0.53(+0.27%)Today

Google, officially known as Alphabet Inc., has evolved far beyond its original search engine to become a powerhouse in a wide array of industries, from advertising and cloud computing to artificial intelligence and autonomous vehicles. Alphabet’s stock ticker symbol is GOOGLE (Class A shares) and GOOGLE (Class C shares), each offering different voting rights.

Investors closely track Google’s stock for its consistent growth and dominance in the digital advertising space. Alphabet’s revenue, driven primarily by Google’s search engine and YouTube platform, continues to grow year after year, making Google stock a key player in the tech sector.

Why Invest in Google Stock?

Strong Financial Performance:

Google has shown impressive revenue growth, largely driven by its advertising revenue. The company’s dominance in search advertising has allowed it to maintain a steady revenue stream, making it a relatively safe investment in volatile markets.

Innovative Products and Services:

Google’s investment in AI, self-driving cars, smart home devices, and cloud computing provides numerous growth opportunities. As the company continues to innovate, it positions itself as a leader in various industries.

Also Read: Fintechzoom Best Neobank – The Most Trusted Digital Banks for 2025!

Stable Market Position:

As of today, Alphabet Inc. holds a dominant position in the global tech landscape. The company’s market capitalization often exceeds $1 trillion, and its ability to stay ahead of competitors has kept Google stock in high demand.

Diversification:

Alphabet’s vast portfolio, which includes companies like YouTube, Google Cloud, Waymo (self-driving cars), and Nest (smart home devices), offers investors diversification, reducing reliance on a single market segment.

Shareholder-Friendly Practices:

Alphabet has implemented stock buybacks, which can be an attractive option for investors looking to boost long-term value. Additionally, its consistent dividend policy could appeal to those seeking passive income from their investments.

Analyzing Google’s Stock Performance:

Historically, Google’s stock has been on an upward trajectory, reflecting both the company’s overall growth and its investor-friendly policies. However, like all stocks, Google’s performance can fluctuate based on broader market trends and economic conditions.

Google Stock Price Trends:

Investors should keep an eye on Google’s stock price movements. Factors like quarterly earnings reports, new product launches, market competition, and regulatory scrutiny can impact the price. Tracking these factors allows investors to identify potential buying or selling opportunities.

Stock Splits and Buybacks:

In recent years, Alphabet has executed stock splits and announced buyback programs to maintain a balanced capital structure. These actions can influence the stock’s liquidity and value, making it a more attractive asset for both short-term and long-term investors.

Google Stock Predictions for 2025:

While stock predictions are never guaranteed, many financial analysts are optimistic about Alphabet’s future performance. Given the company’s leadership in digital advertising, AI technologies, and cloud services, there’s significant potential for long-term growth.

- Cloud Services Growth: Google Cloud, which competes with Amazon Web Services (AWS) and Microsoft Azure, is expected to continue expanding. The growing adoption of cloud computing presents a lucrative revenue stream that could further enhance Alphabet’s stock value.

- AI and Machine Learning: With advancements in AI, Google’s investments in AI and machine learning could drive new product developments and create significant growth opportunities.

- Market Expansion: As Google continues to expand into international markets, particularly in emerging economies, the company’s reach could further solidify its position and potentially lead to increased stock prices.

How to Buy Google Stock?

Buying Google stock is straightforward. Here’s how you can get started:

- Choose a Brokerage: You’ll need a brokerage account to buy Google stock. Popular platforms include Robinhood, E*TRADE, and Charles Schwab.

- Research Stock: Before making an investment, research Alphabet’s stock performance and evaluate whether it aligns with your investment strategy.

- Place an Order: Once you’ve chosen your brokerage and researched the stock, place an order for the desired amount of shares. You can opt for a market order, which buys at the current price, or a limit order, which buys at a specific price.

Also Read: Fintechzoom Best Neobank – The Most Trusted Digital Banks for 2025!

Risks of Investing in Google Stock:

While Google stock offers plenty of advantages, it’s important to consider potential risks:

- Regulatory Scrutiny: Google faces ongoing investigations and lawsuits related to antitrust issues. Regulatory challenges could impact its financial performance or stock price.

- Market Competition: Although Google is a dominant player in tech, it faces fierce competition from other giants like Amazon, Microsoft, and Apple, especially in areas such as cloud services and AI.

- Economic Downturns: Like all tech stocks, Google’s stock price can be affected by economic downturns, which can impact consumer spending and advertising budgets.

Fintechzoom google stock price?

As of January 22, 2025, Alphabet Inc. (Google’s parent company) Class C shares (ticker: GOOGLE) closed at $200.16, reflecting a slight increase of 0.27% from the previous close.

Fintechzoom google stock symbol?

Google’s stock is traded under the symbol GOOG for Class C shares and GOOGL for Class A shares on the NASDAQ.The difference between the two is voting rights, with GOOGLE offering them, while GOOGLE does not.Both are part of Alphabet Inc., Google’s parent company.

Fintechzoom google stock review?

Google’s stock, under Alphabet Inc., is a strong investment due to consistent growth from digital advertising and expanding cloud services. Despite regulatory challenges, the company leads in AI and innovation. It’s considered a reliable long-term investment for growth.

Fintechzoom google stock prediction?

Google’s stock is expected to continue its growth, driven by its dominance in digital advertising, cloud computing, and AI. Analysts predict strong long-term performance as the company expands in emerging markets and innovative technologies. However, regulatory risks could impact short-term fluctuations.

FAQ’s

1. What are the main differences between Google’s Class A (GOOGLE) and Class C (GOOGLE) stocks?

Class A shares (GOOGLE) offer voting rights, while Class C shares (GOOG) do not. Both types of shares are traded on the NASDAQ but have distinct rights for shareholders.

2. How does Google’s dominance in digital advertising impact its stock price?

Google’s dominance in digital advertising generates substantial revenue, providing a stable foundation for its stock price. Investors closely watch this segment as it contributes significantly to Alphabet’s overall growth.

3. What are the major risks associated with investing in Google stock?

Key risks include regulatory scrutiny related to antitrust concerns, intense competition from tech giants like Amazon and Microsoft, and the potential impact of economic downturns on advertising budgets.

4. How has Google’s cloud service, Google Cloud, affected its stock growth?

Google Cloud has become a significant growth driver, competing with AWS and Microsoft Azure. As demand for cloud services increases, this expansion enhances Alphabet’s stock value, positioning it for long-term growth.

5. What role does AI play in shaping Google’s future stock performance?

Google’s ongoing investment in AI and machine learning positions the company for future innovations and new revenue streams, making it a key factor in sustaining its stock growth in the coming years.

Conclusion

Google stock is a strong investment option due to its consistent growth in digital advertising, cloud services, and AI. Despite some risks like regulatory issues and competition, Alphabet Inc. continues to innovate and expand. For long-term investors, Google stock offers stability and opportunities for growth, making it a solid choice in the tech sector.

I’m Arlo Liam, and I bring over 10 years of hands-on experience in the mobile technology field. My journey in mobile technology has been driven by a passion for innovation, usability, and the evolving digital landscape.

From understanding the inner workings of smartphones to exploring emerging trends in mobile software and app development, I am committed to sharing in-depth insights and practical knowledge with users of all levels.