Meta Platforms, formerly known as Facebook, has been a game-changer in the tech industry. When it comes to investing, platforms like FintechZoom provide valuable insights into Meta’s stock performance. This article explores Meta stock’s trends, opportunities, and risks, offering a deep dive into its financial journey and market potential.

FintechZoom helps you follow Meta stock easily. Meta owns Facebook, Instagram, and WhatsApp, making it a big tech company. On FintechZoom, you can see Meta’s stock price, news, and trends. It’s a simple way for anyone to learn and decide about investing in Meta stock.

In this article, we’ll explore “FintechZoom Meta Stock” and how it helps you track Meta’s performance easily.

Overview of Meta Stock:

Meta Platforms Inc. (NASDAQ: META) is a leading social media and technology company known for its platforms, including Facebook, Instagram, WhatsApp, and its ambitious efforts in the metaverse space. As a key player in the digital advertising sector, Meta generates substantial revenue through targeted ads,

Making it a popular choice among investors looking for growth stocks. With the increasing focus on artificial intelligence, augmented reality, and virtual reality, Meta continues to innovate and expand its ecosystem, positioning itself for long-term growth.

Why Investors Follow Fintechzoom for Meta Stock Updates?

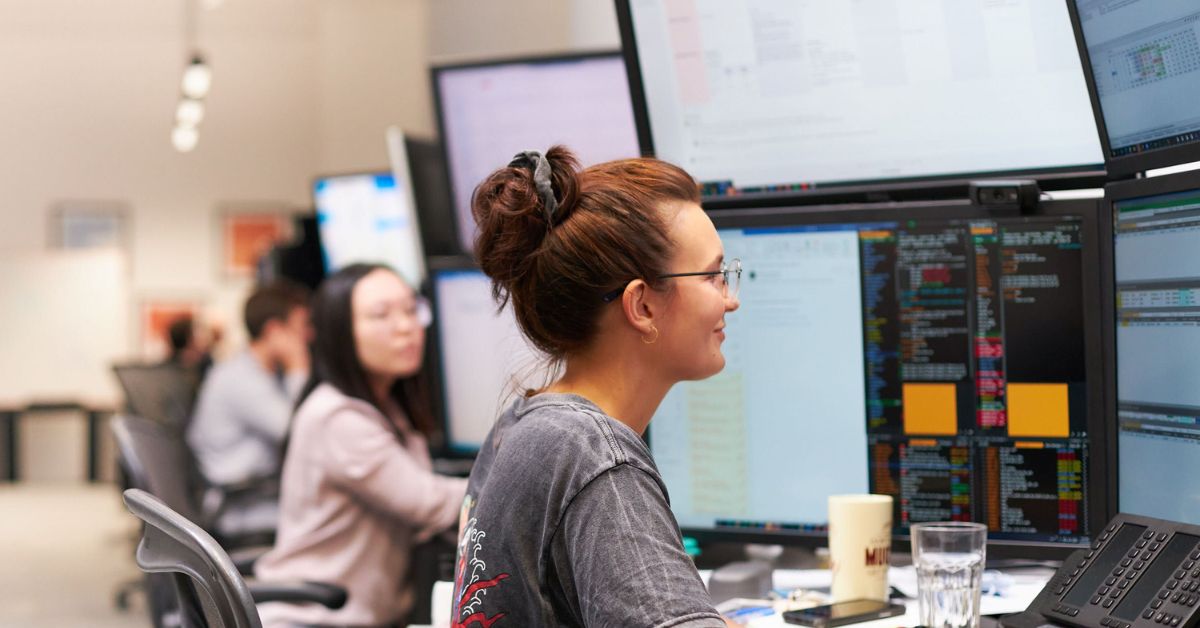

Fintechzoom offers timely updates and expert analysis on Meta stock, helping investors make informed decisions. Some of the key benefits of following Fintechzoom for Meta stock include:

- Real-time Stock Updates: Fintechzoom provides live stock price tracking and market trends to keep investors informed.

- In-depth Analysis: Detailed insights into Meta’s financial health, earnings reports, and market performance.

- Expert Opinions: Contributions from financial analysts and industry experts offering valuable investment perspectives.

- Market Trends: Understanding how market dynamics and macroeconomic factors impact Meta stock.

- Investment Strategies: Guidance on various investment approaches tailored for different risk appetites.

Key Factors Influencing Meta Stock Performance:

Several factors contribute to the performance of Meta stock, including:

- Earnings Reports: Quarterly and annual earnings reports provide insights into the company’s revenue growth, profit margins, and operational efficiency.

- Metaverse Investments: Meta’s heavy investment in the metaverse and virtual reality (VR) sector impacts investor sentiment and stock valuation.

- Regulatory Challenges: Ongoing scrutiny and regulatory challenges can influence stock performance and future growth.

- Competition: Rivalry with other tech giants such as Google, Apple, and TikTok may affect Meta’s market position.

- Economic Conditions: Global economic trends, interest rates, and inflation rates can impact stock prices.

- User Engagement Trends: Monitoring how users interact with Meta’s platforms and services provides insights into future revenue potential.

- Technological Innovations: Advancements in AI, AR, and VR technologies can enhance Meta’s capabilities and attract new business opportunities.

Also Read: Fintechzoom Best Neobank – The Most Trusted Digital Banks for 2025!

Investment Strategies for Meta Stock:

Investors looking to capitalize on Meta stock can consider the following strategies:

- Long-term Holding: Given Meta’s strong growth potential, holding the stock for the long term can yield significant returns.

- Diversification: Balancing Meta stock with other tech stocks or different sectors can reduce investment risks.

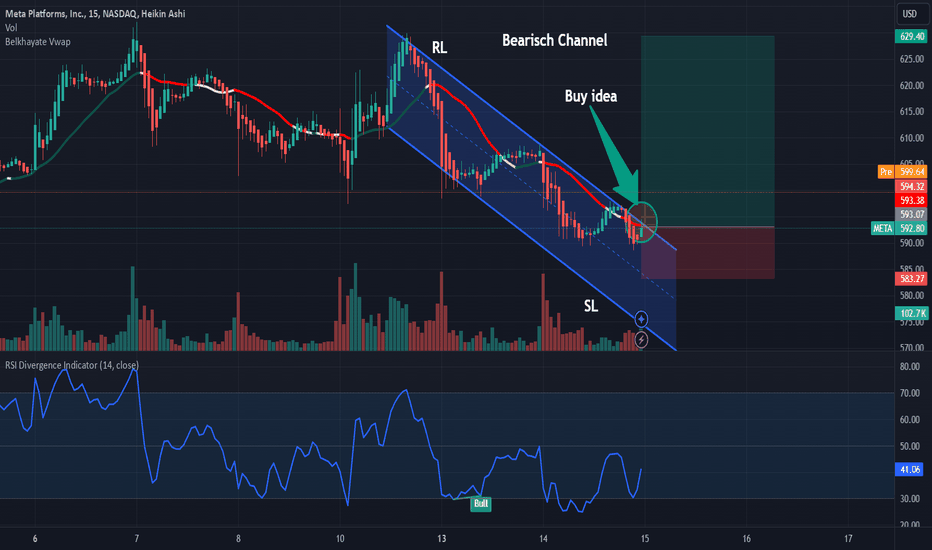

- Technical Analysis: Using chart patterns, moving averages, and market indicators to identify buying and selling opportunities.

- Staying Updated: Regularly checking platforms like Fintechzoom for the latest Meta stock news and expert insights.

- Dividend Considerations: While Meta does not currently offer dividends, monitoring potential changes in dividend policies can be crucial for income-focused investors.

- Risk Management: Setting stop-loss orders and tracking volatility trends can help mitigate potential losses.

Meta’s Future Growth Prospects:

As Meta continues to expand its footprint in emerging markets and develop cutting-edge technologies, the company remains well-positioned for future growth. The increasing adoption of virtual reality through its Oculus products and the expansion of its advertising business in international markets present lucrative opportunities for long-term investors.

Additionally, Meta’s investment in AI-driven content moderation and user experience enhancements aims to improve engagement and brand reputation. Partnerships with leading tech firms and acquisitions of promising startups further reinforce Meta’s potential for sustained expansion.

Is Meta an AI stock?

Yes, Meta (formerly Facebook) is considered an AI stock because it heavily invests in artificial intelligence for content moderation, personalized recommendations, and its metaverse ambitions.

The company develops advanced AI models to enhance user experiences across its platforms. However, AI is just one aspect of Meta’s broader business, which includes social media and virtual reality.

Who owns most of Meta stock?

Mark Zuckerberg, Meta’s CEO, owns approximately 13.68% of the company’s equity, granting him 61.2% of the voting power due to his Class B shares.Among institutional investors,

Vanguard holds the largest stake, owning about 8.4% of Meta’s Class A stock.BlackRock follows, holding approximately 7.1% of Meta’s stock.

What will Meta stock be worth in 2025?

Analyst projections for Meta Platforms’ stock price in 2025 vary, with Jefferies setting a target of $715 and Truist Securities estimating $700. The average price target is approximately $689.12, with a high forecast of $811.00 and a low of $530.00.

These forecasts reflect optimism about Meta’s AI initiatives and potential growth in advertising revenue.

Is Meta a good stock?

Meta is considered a good stock by some analysts due to its strong position in AI, advertising, and the metaverse. The company’s ability to innovate and its large user base support long-term growth potential.

However, risks include market competition and the uncertainty of its metaverse investments, making it a stock for those willing to embrace volatility.

Fintechzoom meta stock price?

As of January 22, 2025, Meta Platforms Inc. (META) stock is trading at $626.67, reflecting a 1.66% increase from the previous close.

FAQ’s

1. What are the key drivers of Meta’s stock price?

Meta’s stock price is influenced by earnings reports, advancements in AI and the metaverse, regulatory challenges, competition from other tech companies, and the company’s user engagement and market trends.

2. How does Meta’s metaverse investment impact its stock?

Meta’s significant investments in the metaverse and virtual reality are seen as both a risk and opportunity. While these ventures are costly, they have the potential to drive long-term growth if successful.

3. What is the role of AI in Meta’s stock performance?

AI plays a crucial role in Meta’s stock performance, from personalized recommendations and content moderation to enhancing the user experience, making it a key factor in its future growth potential.

4. Is Meta a good investment for long-term growth?

Meta is considered a strong long-term investment due to its dominance in digital advertising, innovation in AI and VR, and its potential in the metaverse, despite challenges like market competition and regulatory scrutiny.

5. How does competition from other tech giants affect Meta stock?

Meta faces stiff competition from companies like Google, Apple, and TikTok, which can impact its market position and growth prospects, leading to fluctuations in its stock price.

Conclusion

Meta Platforms, with its strong presence in social media, AI, and the metaverse, presents significant growth opportunities. While the company faces risks like competition and regulatory challenges, its continued innovation and investments position it for long-term success. Investors should stay informed through platforms like FintechZoom to track Meta’s performance and make informed decisions.

I’m Arlo Liam, and I bring over 10 years of hands-on experience in the mobile technology field. My journey in mobile technology has been driven by a passion for innovation, usability, and the evolving digital landscape.

From understanding the inner workings of smartphones to exploring emerging trends in mobile software and app development, I am committed to sharing in-depth insights and practical knowledge with users of all levels.